Capitalize on the Seasonal Patterns of the Market

Turning Noise Into Actionable Insights

What is Seasonality?

Seasonality is a characteristic of price data which exhibits consistent and predictable movement that recurs every calendar year on average. Some simple examples include:

- agriculture harvests and planting seasons

- holiday shopping spikes for retail stocks

- higher utility and energy prices in winter

- political elections and campaign season

- earnings and product announcements

- Turn of the month effect

- Tax loss harvesting

- month end window dressing

These repeatable patterns happen on all time frames and there is finally a tool to help traders capitalize on seasonality! Read more from Investopedia.com here: Seasonality Definition

Discover our Services

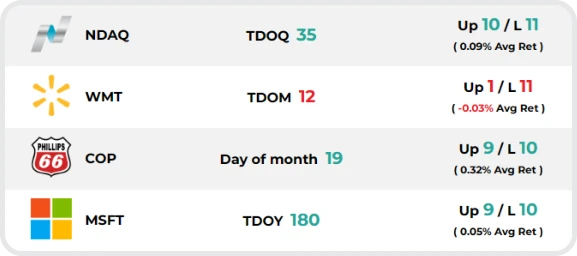

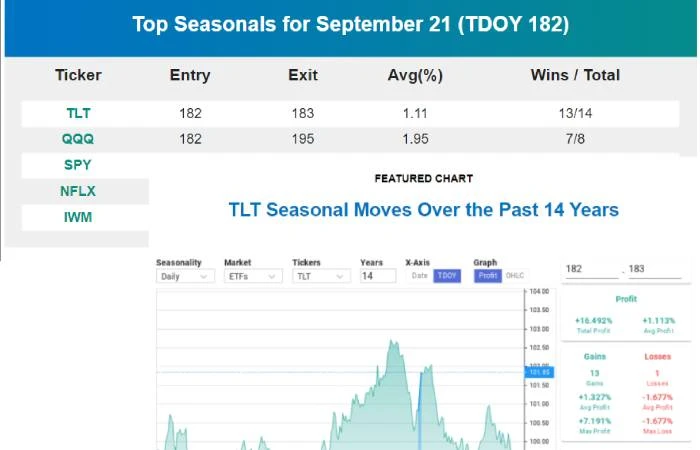

Seasonal Cheat Sheet

A daily cheat sheet of historically favorable trades, including entry and exit points, stop-loss levels, and profit targets. It uses technical analysis, market trends, and expert insights to identify profitable trading opportunities for the upcoming day.

Daily Email

The best historical performing trades sent to your inbox daily. Daily, intraday and now options structural trades that have performed well on this trading day in the past. Find out what moves during this upcoming market period before it does.

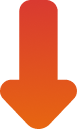

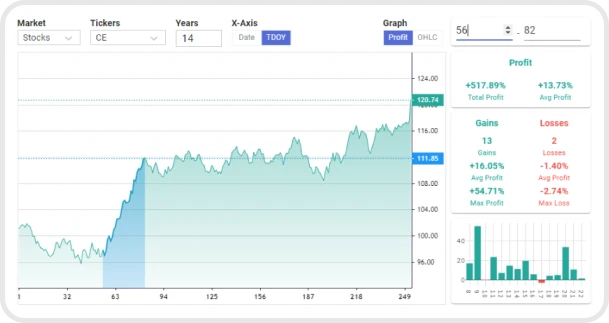

Best Seasonal Trading Tool

A seasonal trading tool to hunt ideal periods to add or reduce exposure. Traders and investors looking to capitalize on predictable market patterns can discover them easily with our tools.

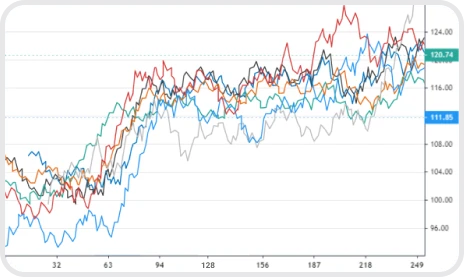

Composite Charts

Find the opportune windows to add exposure or reduce positions in any stock, ETF or mutual fund. We isolate historically profitable periods and display performance from any trading week or trading day of the year.

Newly Added Options Features

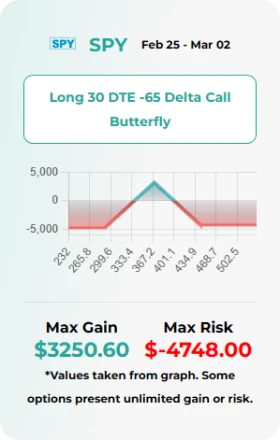

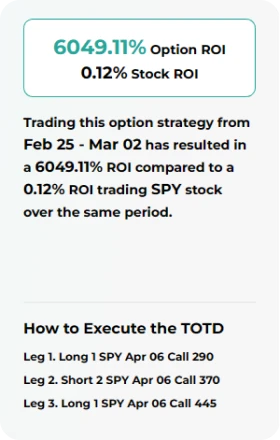

Best Option Trades

Historically profitable option trades. Quickly see which option structures have provided the greatest return on investment over historically favorable seasonal periods for all popular stocks.

Buying stock may yield a smaller return than putting on a similarly positioned option trade. Options may also provide income in the event of sideways trading or an uncooperative market environment.

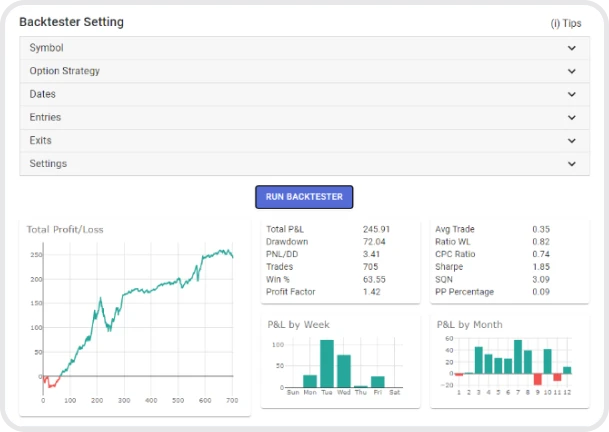

Option Backtesting

Test and evaluate option trading strategies based on historical seasonal data and factors. Find the best seasonal factors and pair them with the best option trade structure. View historical performance and full list of past trades.

What PROs say about Seasonal Trading

find out what people who have trusted us say about us

Seasonal trading is no BS. Trades are delivered before they occur and are backed by data. This is the only transparent way to time the markets. The value of this subscription is tremendous.

I have already recommended three of my other trader friends to sign up. Thanks for the work you guys do.

Day trading without knowing intraday behaviors is a fool’s game. I build my watchlist the night before and can check the intraday charts as well.

This has saved me some false tops and falling knives no doubt. So simple but not sure why more day traders don’t look at this stuff.

Frequently Asked

Seasonality Questions

An expected price move based on historical data that has shown similar price movements in the past. To read more on seasonal patterns please check out this other blog highlighting seasonality trading strategies

Additionally, we wrote an in-depth blog about Seasonality here: What is Seasonality in Trading?

Spread trading is most common in commodity markets where deliverable future contracts have an expiration date. A trader may seek to buy the March contract and simultaneously sell the June contract. This position or difference between the two contracts is referred to as a spread. Spreads between different expirations or different commodities altogether can exhibit their own seasonal patterns and tendencies.

Spread trading is very common among professionals, commercials, and hedge funds alike. These are often less looked at by retail traders as it is often difficult to find accurate quotes of the spread itself. However, we aim to provide not only accurate pricing but seasonality insights for as many spreads as we can cover.

Swing trading usually consists of holding a position for more than a day and often a few days, weeks or even months while the trading position matures. Looking for shorter-term directional movement is often harder than long-term investing which focuses on the underlying business’s fundamentals. Seasonality and seasonal trading can often provide solid reasoning and logic as well as narrow the symbol universe for traders looking to enter profitable swing trades. Swing traders often lean on seasonality as a primary factor in their trading decisions due to the statistical nature and grounded logic behind the data.

To learn more about Swing Trading with Seasonals please check out this full guide here: Seasonal Swing Trading Guide

Free Trial

Seasonal Trading

Try Seasonal

Trading

- Full Access To Best Options

- Complete Cheat Sheet

- Daily Email

- Option Backtester

- Seasonal Tool and Watchlist

- 7 Day Free Trial

$30MONTHLY

Try Seasonal

Trading

- Full Access To Best Options

- Complete Cheat Sheet

- Daily Email

- Option Backtester

- Seasonal Tool and Watchlist

- 7 Day Free Trial

$300ANNUAL

Capitalize on the Seasonal Patterns of the Market